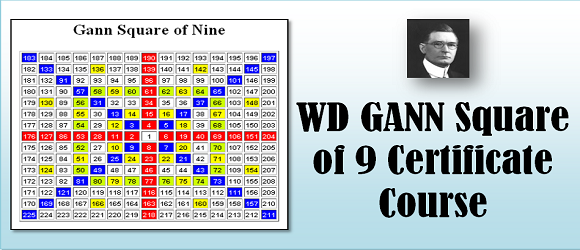

The eighth circle around is completed at 169, a gain of 42 over the first. Note that this completes the first Hexagon and as this equals 127 months, shows why some campaigns will run 10 years and seven months, or until they reach a square of the Hexagon, or the important last angle of 45°. In other words, when ‘is’ have traveled six times around we have gained 36. Note that from the first the gain is 6 each time we go around. The sixth circle is completed at 91, a gain of 30 over the previous circle and the seventh circle at 127, a gain of 36 over the last circle. The fifth circle is completed at 61, a gain of 24 over the previous circle. The fourth circle around is completed at 37 – a gain of 18 over the previous circle. We then place a circle of circles around this circle and six circles complete the second circle, making a gain of 6 over the first one, ending the second circle at 7, making 7 on this angle a very important month, year, and week as well as days, the seventh day being sacred and a day of rest. We begin with a circle of “1”, yet the circle is 360° just the same.

The whole range of executioners, there are 9 of them, creates a fan.Since everything moves in a circle and nothing moves in straight lines, this chart is to show to you how the angles influence stocks at very low levels and very high levels and why stocks move faster the higher they get, because they have moved out to where the distance between the angles of 45° are so far apart that there is nothing to stop them and their moves are naturally rapid up and down. Gann angle lines are drawn between the significant minimum and maximum price and run at different angles. This is called 1 * 1 angle (unit of elapsed times is accompanied by a change in price by unit). This balance occurs when prices rise or fall at a 45 degree angle to the time axis. As I wrote at the beginning, he argued that there is a perfect balance between the passage of time and price changes occurs on the capital market. Gann was also the originator of techniques combining geometric angles with prices and time series. These levels are often mathematically related to a number, which can be the “base” number (that is, the lowest level) in the square. Gann stated that the trend reversal usually occurs when prices have moved a certain distance.

The year has 365 days, so Gann brought it closer to 360 to assume that 1 day = 1 wheel. The square presents price changes, while the circle is responsible for determining the estimated date when a given price will occur. First of all, Gann did not specify which of the many intersecting numbers are really significant, and therefore all of them are potentially important.

0 kommentar(er)

0 kommentar(er)